For instance, FCFE can be far lower if the principal on a debt obligation was repaid.

FREE CASH FLOW CALCULATOR FREE

Fluctuations in FCFE: The free cash flow to equity (FCFE) of a company fluctuates across different periods.There are two downsides to using the P/FCF multiple: Therefore, the higher the P/FCF multiple, the more of a premium at which the market values the company on a FCFE-basis (and vice versa for a lower P/FCF multiple). The P/FCF ratio answers the question, “For each dollar of a company’s levered free cash flow (FCFE), how much are investors in the market currently willing to pay?”

FREE CASH FLOW CALCULATOR HOW TO

How to Interpret Price to Free Cash Flow Ratio? Note: If the company raised more debt capital, the proceeds are a net addition to FCFE, since the newly obtained cash can be used to issue shareholders dividends or repurchase shares. The formula to calculate the P/FCF multiple is as follows.įree Cash Flow to Equity (FCFE) = Net Income + D&A – Change in NWC – Capex – Mandatory Debt Repayment Unlike the free cash flow to firm (FCFF) – the cash flows applicable to all stakeholders in a company’s capital structure – FCFE is calculated after adjusting for non-equity payments such as mandatory debt amortization and interest expense (and the residual cash flows then belong to the equity holders). On that note, the free cash flow to equity (FCFE) is the right metric to use alongside equity value, since FCFE is also attributable to solely common shareholders. debt in the capital structure is not part of the calculation. The equity value of a company is equal to the product of a company’s share price and its total number of diluted shares outstanding, i.e. In order for a valuation multiple to be practical, the stakeholder(s) represented must match between the numerator and denominator otherwise, there is an inconsistency in the ratio. Often referred to as “levered free cash flow”, FCFE is the cash flows generated by a company that belong to only common shareholders. at its simplest, the equity value is equal to enterprise value minus net debt – the free cash flow to equity (FCFE) is the corresponding cash flow metric.

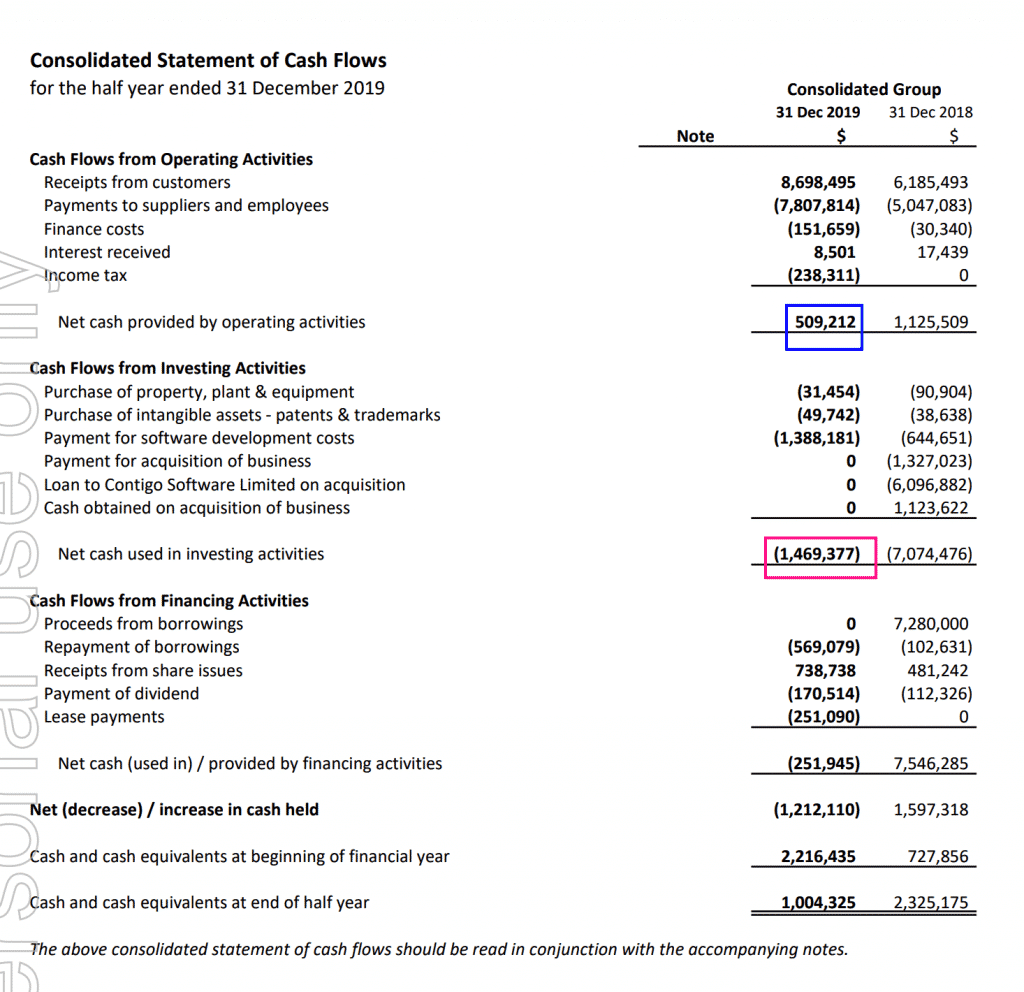

Levered free cash flow = 4066 MUSD - 857 MUSD - 600 MUSD - 16 MUSD We cannot state that are precisely "mandatory debt payments", but considering overall debt service coverage, we can consider it a good proxy. There you will find an item called "Repayment of Convertible Notes". Check the "cash flow from financing activities section". Regarding CapEx, you can find it in cash from investing activities section as "Purchases of property and equipment and intangible assets."įinally, we need to obtain the mandatory debt payment amount. Net change in working capital = -857 MUSD You can find them in the cash flow statement, particularly in the cash flow from operating activities section as: "Changes in operating assets and liabilities."

Once we have EBITDA, the next items in the levered free cash flow formula are the net change in working capital, the capital expenditures (CapEx), and the mandatory debt payment. The reason for an interest income might be because of a high amount of short-term investments that generate interest. Besides, we are also subtracting the interest expense because there was an interest income. We are subtracting the effective corporate tax because there was a tax benefit, not an expense. Remember:ĮBITDA = net income + interest paid + tax income + depreciation & amortizationĮBITDA 2019 = 4,141 MUSD - 92 MUSD - 245 MUSD + 262 MUSD We will use Nvidia 2019 financial statements for building the levered free cash flow formula.įrom page 41 (the income statement) and 45 (the cash flow statement), we can build EBITDA.

0 kommentar(er)

0 kommentar(er)